Ukraine’s Debt Falls as Minister’s Exit Shows Government Cracks

Ukraine’s Eurobonds slumped the most since a debt restructuring last year after the nation’s economy minister resigned, raising concerns the country’s efforts to overhaul its economy are unraveling.

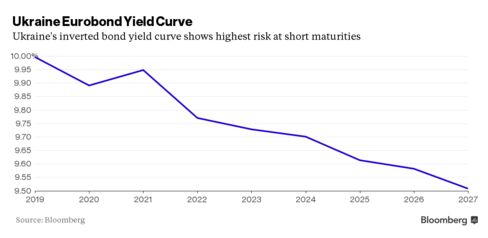

Dollar-denominated bonds maturing in 2019 tumbled, with yields rising 50 basis points to 10.11 percent by 4:07 p.m. in Kyiv, heading for the steepest increase since the notes were first traded in November. The yield premium on the 2019 notes, which are Ukraine’s next maturing Eurobonds, widened to the most in a month over the country’s debt due 2027 to trade 59 basis points higher.

Aivaras Abromavicius stepped down on Wednesday saying he won’t be a “puppet” to other state officials who he claims are blocking legislation to turn the war-torn country’s economy around and attract investment. The minister’s resignation highlights the country’s difficulties in keeping a $17.5 billion International Monetary Fund payment on track amid political wrangling over tax reform, even as the government in Kyiv secured debt relief in a restructuring agreement with its private creditors last year.

“The repricing of the Ukrainian bond curve is somewhat logical as not complying with the IMF requirements would mean default,” Regis Chatellier, an emerging-market strategist at Societe Generale in London, who recommends buying the country’s debt on its attractive carry, said by e-mail. “The fact that he is leaving is a concern for investors that the commitment to implement the reforms can fade.”

Lithuanian Citizen

Abromavicius, a Lithuanian citizen, was one of several foreigners drafted into the post-revolution cabinet to add impetus to plans to steer the nation away from its Soviet past. U.S.-born Finance Minister Natalie Jaresko led negotiations with creditors on the country’s debt overhaul.

The 40-year old minister’s resignation again underscores the fragility of the cabinet, said Timothy Ash, head of emerging-market strategy at Nomura International Plc. in London. However, Abromavicius’s exit doesn’t mean the cabinet will fall “just yet,” Ash said.

“It will force the issue of the looming cabinet reshuffle and refocus attention on the need to push on and deliver difficult reforms,” Ash said in an e-mailed note.

The hryvnia currency, which is tightly controlled by the country’s central bank, rose 0.8 percent to 25.7 per dollar after falling to an 11-month low on Tuesday.

Private creditors owning $15 billion in Ukraine’s bonds agreed to restructure their investments last year in a deal that included a 20 percent reduction to debt principle and extending maturity by an average four years.